The 4 Pillars Behind Every VillaAudit Evaluation

We don’t sell villas. We don’t earn commission. We exist for one purpose: to help you avoid expensive mistakes and buy with confidence.

What We Check — Beyond the Brochure

Every villa we audit is measured against four core pillars: hidden technical risk, true livability, real economic value, and long-term location logic.

Uncover Hidden Issues Before They Drain Your Wallet

Bali’s climate hides problems most buyers miss. We identify them before they turn into €5,000–€30,000 surprises.

- Mold, humidity, ventilation issues

- Waterproofing weak points

- Material decay signs

- Maintenance expectations

- Where failures happen first in Bali

Articles: Building Quality & Climate

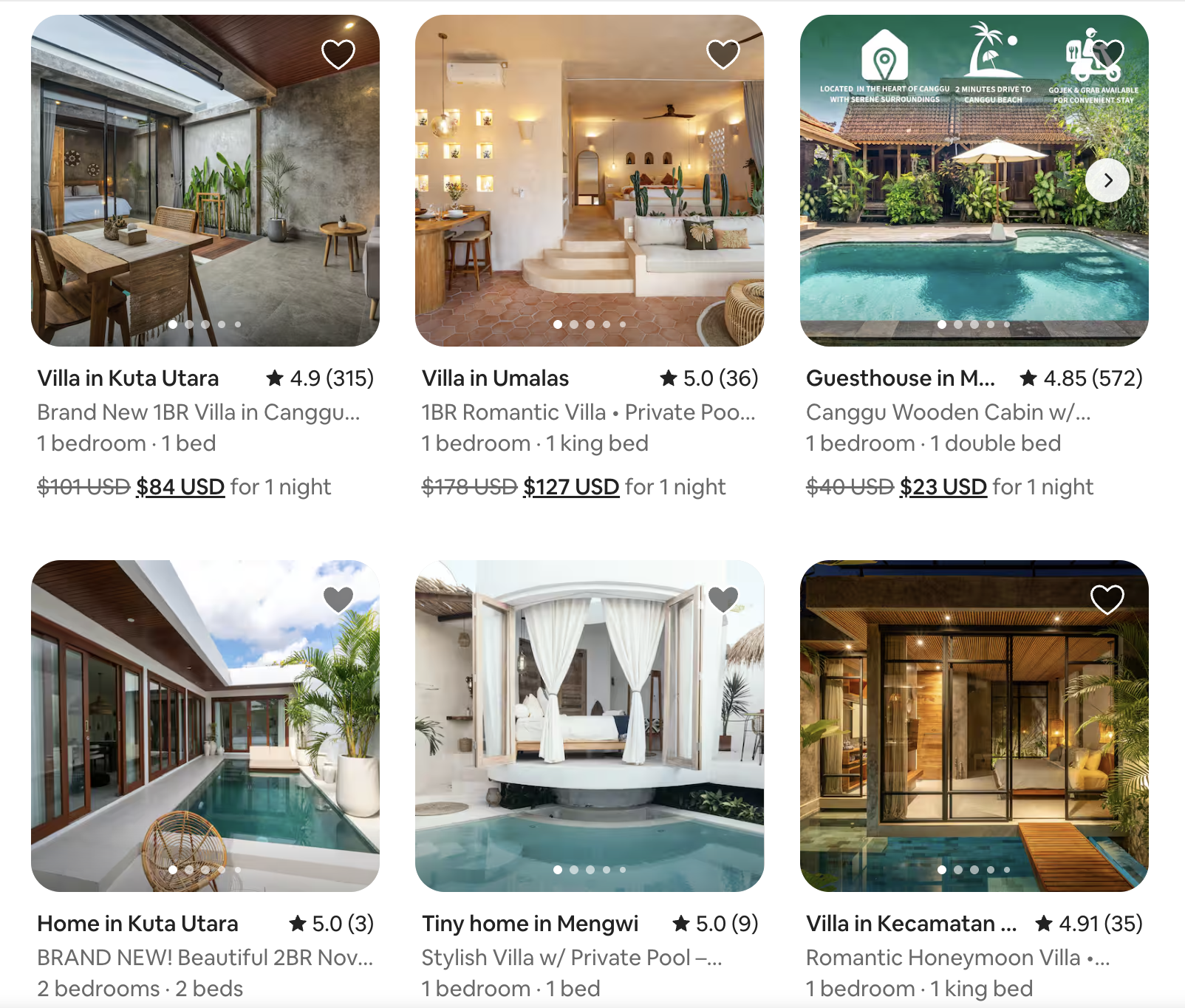

Confirm the Villa Matches Reality — Not the Photos

Most villas are staged for Instagram. We check the real living experience.

- Noise & privacy

- Heat zones & airflow

- Real light quality

- Layout practicality

- Long-stay / short-stay suitability

Know Whether This Villa Is Actually Worth Buying

We assess fair value, realistic rentability, and alignment with your goals.

- Overpricing vs fair value

- Honest ADR & occupancy

- Demand type

- Management cost impact

- Lifestyle vs yield match

Choose a Location That Stays Valuable Over Time

Moving 300m in Bali changes everything. We prevent bad location mistakes.

- Flood risk

- Noise & development nearby

- Access clarity

- Neighborhood lifecycle

- Appreciation potential

What This Looks Like in Real Life

A few recent examples of how the pillars above protected buyers from costly mistakes.

Example

€22,000 in hidden repairs avoided

A villa with perfect photos but failing waterproofing in bathrooms and roof. Our audit quantified repair costs and helped the buyer walk away before committing.

Example

Family avoided a high-noise villa near a planned club

Location check revealed future nightlife zoning, traffic patterns, and noise risk that would have made the villa unlivable for a relocating family.

Example

ROI corrected from 12% to 6% using real data

Marketing spreadsheets promised 12% yield. After adjusting ADR, occupancy, OPEX and refresh costs, the true yield was closer to 6% — changing the buyer's strategy.

Not a Checklist. A Custom Evaluation Built Around You.

Every villa, every buyer, every goal is different — so our evaluation is built around you, not a generic template. What you receive is not a scanned checklist, but a custom assessment shaped by your goals, risk profile, and investment logic.

You Tell Us Your Goals — We Design Exactly What You Need

We align the evaluation with your risk tolerance, preferences, and decision logic — not a generic checklist.

- Risk tolerance

- Non‑negotiables

- ROI & holding strategy

- Budget & deal structure

We Translate Goals Into Architecture + Market Reality

We verify how the villa holds up under Bali conditions and market constraints.

- Structure, drainage & humidity risk

- Durability & maintenance reality

- Land logic & micro‑location

- Real rental potential

You Receive a Decision-Ready Report

Clear, structured, investor-oriented — built to support a buy / negotiate / avoid decision.

- Architectural findings (plain English)

- Pricing evidence + ROI realism

- Negotiation leverage points

- Final verdict

Personalized Strategy — Not Sales Pressure

We help you compare options and refine your next move — with zero upsell and zero commissions.

Not sure where to start?

Review buyer-side services, or book a short call to confirm fit.

Book Call: 15‑min buyer-side fit check for your link, shortlist, or goals. No pressure — just clarity.